Introduction

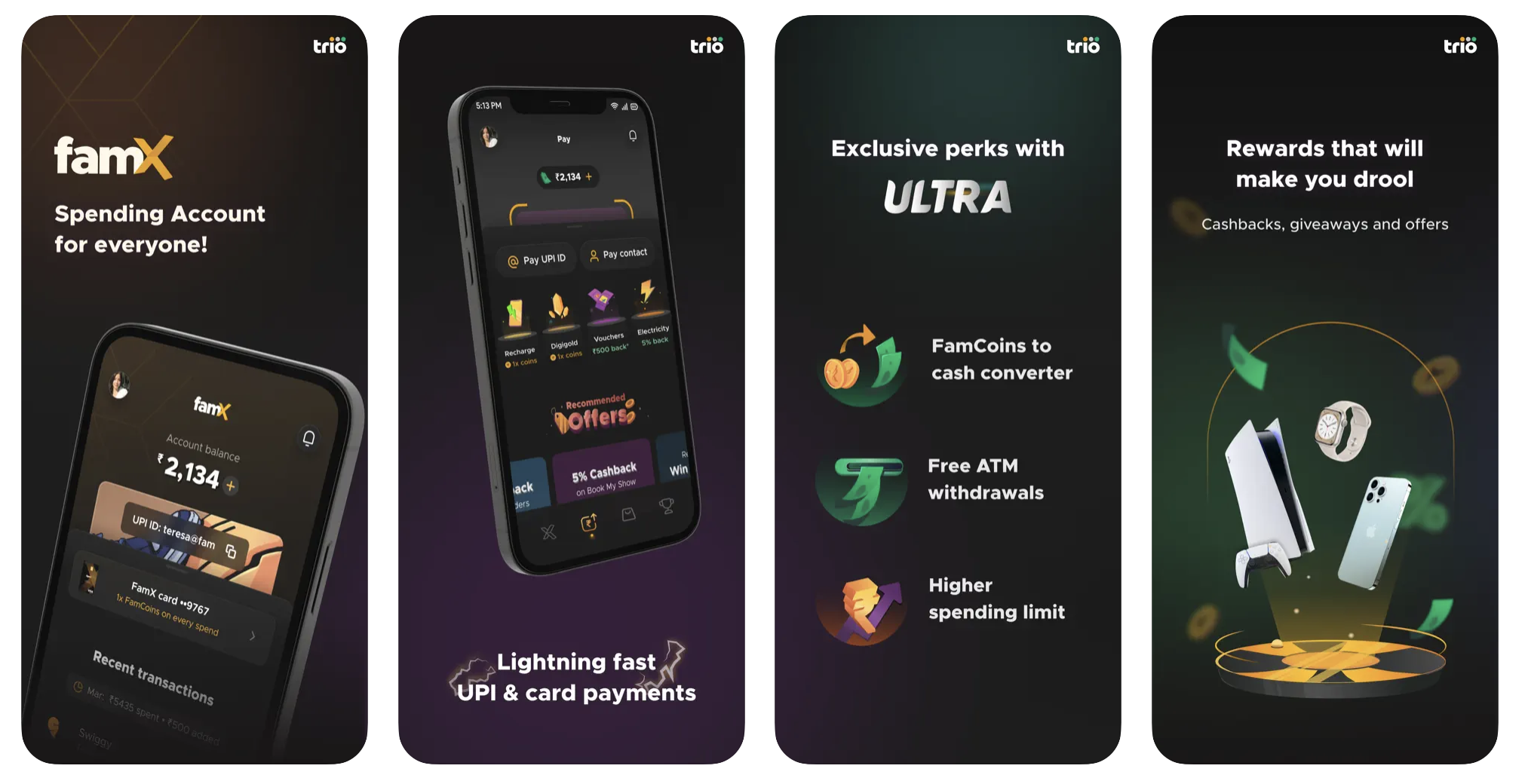

FamApp, rebranded from FamPay, is a pioneering financial platform in India tailored for the young generation. It aims to foster financial inclusion among teenagers and young adults by offering a secure and user-friendly environment to manage their finances. Key features include a unique “Spending Account,” a personalized UPI and card system, and a focus on financial literacy.

Market Research and Competitive Analysis

- Market Trends: Examination of the financial service sector’s evolution, especially in youth-centric financial products.

- Competitive Positioning: Analysis of FamApp’s unique place in the market compared to traditional and digital banking services.

Target Demographics and User Engagement

- User Demographics: Insights into the age group, preferences, and spending habits of FamApp’s users.

- Engagement Strategies: Review of FamApp’s approaches to engage and retain its young audience.

Product Features and Innovation

- Account and Payment Features: Overview of the FamX account, including its universal spending account and customized card offerings.

- Innovative Features: Discussion on the numberless card, personalized QR themes, and doodle card designs.

User Experience and Customer Feedback

- User Interface and Accessibility: Analysis of the app’s design, ease of use, and accessibility features.

- Customer Feedback: Summary of user reviews and ratings, highlighting strengths and areas for improvement.

Financial Education and Literacy

- Educational Tools: Exploration of FamApp’s initiatives in promoting financial literacy among its users.

- Practical Learning: How FamApp’s features contribute to real-world financial education for teenagers and young adults.

Technology and Security

- Technical Infrastructure: Delve into the technological backbone of FamApp, including app security and transaction speed.

- Security Features: Emphasis on security measures, especially regarding the numberless card and online transactions.

Growth Strategy and Market Position

- Growth Trajectory: Analysis of FamApp’s growth in terms of user base and market reach.

- Strategic Partnerships: Overview of collaborations and partnerships that enhance FamApp’s offerings.

Challenges and Regulatory Landscape

- Operational Challenges: Discussion of the challenges in scaling and maintaining service quality.

- Regulatory Considerations: Understanding the regulatory implications of catering to a younger demographic in the financial sector.

Future Projections and Opportunities

- Market Expansion: Potential strategies for FamApp to expand its services and user base.

- Innovative Opportunities: Identification of emerging trends and opportunities for FamApp to explore.

Conclusion

A conclusive summary emphasizing FamApp’s role in shaping financial independence and education for the younger generation in India. The conclusion will reiterate the platform’s success, potential challenges, and future prospects.